ESG reporting requirements (CSRD)

March 2024

A summary of the implications, risks and opportunities of the Corporate Sustainability Reporting Directive (CSRD).

CSRD entry into force

On 1 January 2024, the Corporate Sustainability Reporting Directive (‘CSRD’)[1] entered into force. This directive requires certain categories of companies to report on the impact of their activities on people and the environment in a uniform and transparent manner. The directive must be incorporated into national legislation by 6 July 2024. For many companies, this has consequences. Below, we summarise what this means for you and how Halsten can support you in implementing the CSRD.

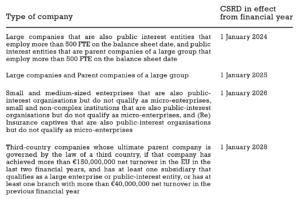

The CSRD applies (among others) to the following companies and takes effect in phases[2]:

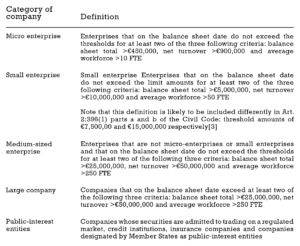

The main categories of enterprises are defined as follows:

What does the Corporate Sustainability Reporting Directive (CSRD) mean for you?

In a nutshell, the CSRD (entered into force on 1 January 2024) means that an organisation must start reporting in the annual report not only on the effects of their activities on people and the environment, but also on how sustainability issues affect the company. This has been labelled as the dual materiality analysis. This approach enforces a holistic approach that examines the actual impact of day-to-day activities. The report is an integral part of the board’s annual report and must be filed together with the financial statements. It is therefore not a separate report.

The exact scope of the reporting obligation should be determined by each company for itself based on the double materiality analysis. In addition, the CSRD sets other reporting requirements, including describing the goals, strategies, processes and role of the board towards sustainability objectives.[4] This will give investors, consumers and policymakers a more accurate picture of companies’ (non-financial) sustainability performance.

The method of reporting is laid down in the European Sustainability Reporting Standards (ESRS). Various standards apply depending on the subject: environment, social or governance. The ESRS basically provides a very detailed framework for analysing sustainability opportunities and risks. With this analysis, the company’s goals and strategies can be revised and processes and measures implemented to exploit/manage these opportunities and risks.

Incidentally, the ESRS have not yet crystallised, and the implementation of the sector-specific standards has been delayed by two years.[5]

The risks and opportunities of the CSRD

The CSRD includes legal obligations and failure to comply with it may result in the auditor withholding approval of the annual report. Also, failure to comply with the CSRD may result in fines from the national regulator. In the Netherlands, this is the Authority for Financial Markets.

Implementing the CSRD also offers advantages:

- Preparing a sustainability report can improve cooperation and mutual understanding with your relations (upstream and downstream) through mutual exchange of information regarding the CSRD;

- The CSRD provides a tool to identify opportunities and risks related to sustainability. This information can then be used to optimise goals, strategies and processes, further ensuring the continuity of the organisation;

- Due sustainability reporting also improves opportunities with lenders and investors, contributes to an organisation’s reputation and can actually prevent reputation damage.

How can Halsten help?

Implementing the CSRD is a tough task for any company. The reporting requirements can be very detailed, and it can be difficult to retrieve all the information inside and outside the organisation.

As previously mentioned, at its core, the CSRD is an obligation to analyse and report opportunities and risks related to sustainability. Halsten has extensive experience in opportunity and risk management and can support you in performing a double materiality analysis. We do this in close cooperation with the people in your organisation who can contribute to the sustainability report.

During the first analysis, we can map out which information is already present within the organisation and which external ‘stakeholders’ are important. With our substantive legal knowledge and our knowledge of business processes, we can make a plan of approach to achieve a qualitative sustainability report. Preparing the full sustainability report is a process involving many disciplines in the organisation and is time-consuming, especially if it has not been done before.

In addition to drawing up an action plan, Halsten can also fulfil specific, legal reporting obligations. Here, we think, for instance, of governance reporting obligations. We can also make concrete adjustments for the implementation of the CSRD, such as adapting the standard contract models, the privacy policy and HR policy with regard to labour law. We also monitor whether the report does not unintentionally lead to ‘greenwashing‘, for instance because it contains statements that are too rosy or that cannot be properly substantiated.

Any questions on the CRSD and its implementation?

We are happy to consult on the concrete implementation of the CSRD. Please contact Halsten colleagues:

Saskia Baan

saskia.baan@halsten.nl

Vincent Roos

vincent.roos@halsten.nl

[1] Publications Office (europa.eu)

[2] Art. 3 Directive 2013/34 (Accounting Directive) and Art. 5 CRSD. Companies that are part of a larger group may be exempt if the EU or non-EU parent company prepares a consolidated report for the entire group in accordance with the CSRD (Art. 1(4)(9) CSRD).

[3] (in Dutch) Wetgevingskalender overheid

[4] Art. 1 limb 4 CSRD

[5] europarl.europa.eu

Andere artikelen

-

Strategic Legal Support for Start-ups and Scale-ups

-

Halsten M&A: highlights 2024

-

Best Workplaces for Women Award

-

Transaction AnQore

-

Series D-round EFFECT Photonics

-

Saying goodbye to co-founder Sietske

-

Applicability Digital Services Act

-

European regulation on artificial intelligence (AI)

-

Publication of Handbook on Noise

-

New website launch

-

Legal Ops lunch update

-

Halsten's new head office